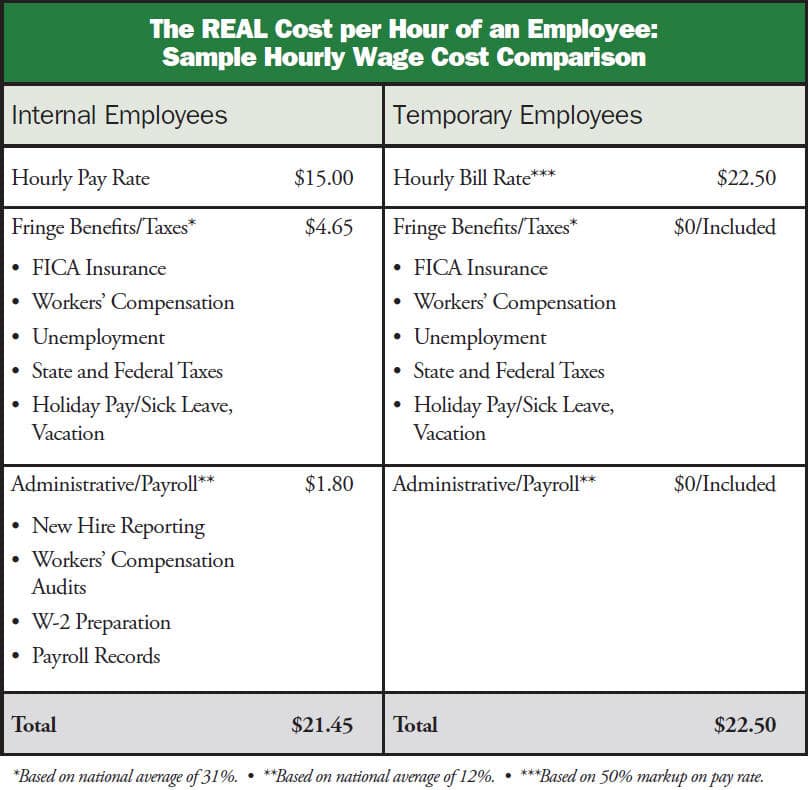

Employees cost much more than their hourly wages. Once you add in the statutory taxes, benefits costs, and personnel administration expenses, the true cost of an employee is typically 40% to as much as 100% above the hourly wage.

When you compare the true hourly cost of a temporary employee against an in-house employee, the costs are less than 5% apart. But with a temporary, there are cost savings you just can’t get with a full-time employee. For example:

- Less idle time. Temporary employees only work when you need them, so you don’t pay for hours you don’t

- Less non-productive Statistics show that full-time employees spend as much as 25% of their work day on non-productive activities like meetings, water cooler talk and surfing the web. Temporary employees have fewer distractions and as a result lose far less of their work hours.When you factor in the inherent productivity costs associated with full-time employees, temporary workers will cost you 25-30% less to get the same work done!

What about overtime expenses?

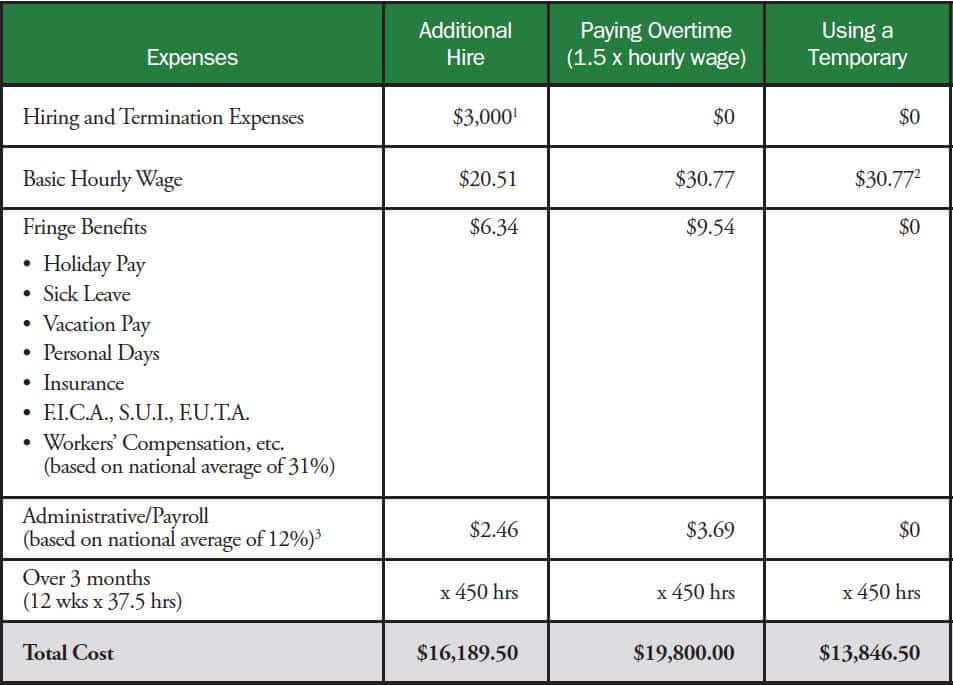

Overtime is even more costly. Many companies believe it is less expensive to push current staff harder, and pay overtime costs, than to bring in additional employees. In reality, it is the most expensive option of all. And the direct expense does not even consider the effect overtime has on your employees’ morale, stress level, and productivity. If you have a short-term staffing need, the most cost-effective solution may be to use temporary personnel. The following case study will help you evaluate the cost-effectiveness of using staffing for your company.

Case Study

Overtime vs Temporary Staffing

John Matthews, CEO of JC Dithers Organization, won a contract with Triax, Inc. The project will require the use of one administrative employee, and will take approximately three months to complete. Mr. Matthews must decide whether to hire an additional employee, pay his current administrative person overtime, or bring in a temporary administrative assistant. The following chart shows the cost analysis Mr. Matthews and his staff completed to determine the best solution.

Cost Analysis:

(Based on an annual salary of $40,000 for one administrative employee.)

To determine the hourly pay rate, Mr. Matthews and his staff used the following equation: $40,000/52 weeks = $769.23/wk.; $769.23/37.5 avg. hrs. per week = $20.51/hr.

1 Hiring costs include the cost of advertising, resume screening, interviewing (by HR and hiring manager), reference checking, skill or assessment testing, and employment paperwork processing. Termination expenses include HR time, but do not include any severance.

2 Temporary staffing rates will deviate depending upon market area. However, the relationship (ratio) will remain the same.

3 Percentages based on U.S. Chamber of Commerce statistics, which include firms that pay no benefits. For small firms with moderate benefits programs, this cost is typically 40-45% of payroll, and for larger firms with extensive benefits programs, the cost can be up to 100% or more of payroll.

Conclusions

Whether you need help hiring a new employee or additional personnel on a temporary basis, staffing services can lower costs, improve focus, and reduce the risk of not finding qualified candidates through traditional resources. In evaluating the economics of staffing, consider the following: In assessing a staffing strategy’s cost, the benchmark should be the difference between the cost of getting the same volume of quality work done in the same time frame by regular employees versus the cost of using alternative staff. When budget analysts complain that the company is over budget on temps, they rarely compare what it would have cost to have the same volume of work done by conventional employees.

Reference: Greble, Thomas C. “A Leading Role for HR Alternative”